WIZBL establishes a small bank in Lithuania "actively pursuing"... Prepare PI&EMI licenses

CEO Park Kon said, “We will introduce global financial payment services after obtaining a license within this year.”

Blockchain technology company “WIZBL” is actively seeking to establish a small bank in Lithuania, a European IT powerhouse.

“By the end of this year, we will introduce global financial settlement services by obtaining PI&EMI licenses that are eligible to run global financial businesses in Lithuania,” said CEO Park Kon of WIZBL.

As financial payment services are a regulatory sandbox in Lithuania, the goal is to proactively establish a special purpose bank centered on Blockchain and virtual assets.

In particular, Lithuania has a business-friendly policy, and the initial minimum capital requirement for issuing licenses for special purpose banks is nearly five times lower than that of traditional banks. Authorization is also two to three times faster than other European countries. It also provides various tax credits and incentives for investment businesses to attract companies.

In addition, there are many ICT (Information and Communication Technology) professional education graduates and workers in the country, and there are many talented people who speak English and European languages.

This is why companies targeting global financial services are attempting to acquire licenses in Lithuania.

A PI license in Lithuania is a license that applies to online payment processing and can act as a currency exchange upon acquisition. In addition, if the company obtains an EMI license that allows e-money transactions, it can provide account opening, remittance and foreign exchange services. If both are acquired, electronic wallets and other payment services may also be available.

“We are working to acquire PI&EMI licenses that can provide global finance and payment services,” said CEO Park Kon of WIZBL. “If S-BANK licenses are obtained, small banks will be established perfectly.”

“We will quickly obtain licenses in Lithuania, where regulatory sandboxes are widely applied, and spread financial settlement services using Blockchain around the world,” he said.

The reason why WIZBL is confident in launching global financial payment services using Blockchain is due to the speed of service processing that has been recognized internally and externally.

The essential success factors of global financial services are fast processing speed and high reliability.

Unlike existing financial settlement services, WIZBL chose a decentralization method rather than central server-centered data concentration to optimize transaction (service execution) processing and verification speed to speed up block creation. Through this, it completed the development of ‘BRTE 2.0’ that can be processed in real time last year and plans to start commercializing BRTE 2.0 services from March of this year.

“By the end of this year, we will introduce global financial settlement services by obtaining PI&EMI licenses that are eligible to run global financial businesses in Lithuania,” said CEO Park Kon of WIZBL.

As financial payment services are a regulatory sandbox in Lithuania, the goal is to proactively establish a special purpose bank centered on Blockchain and virtual assets.

In particular, Lithuania has a business-friendly policy, and the initial minimum capital requirement for issuing licenses for special purpose banks is nearly five times lower than that of traditional banks. Authorization is also two to three times faster than other European countries. It also provides various tax credits and incentives for investment businesses to attract companies.

In addition, there are many ICT (Information and Communication Technology) professional education graduates and workers in the country, and there are many talented people who speak English and European languages.

This is why companies targeting global financial services are attempting to acquire licenses in Lithuania.

A PI license in Lithuania is a license that applies to online payment processing and can act as a currency exchange upon acquisition. In addition, if the company obtains an EMI license that allows e-money transactions, it can provide account opening, remittance and foreign exchange services. If both are acquired, electronic wallets and other payment services may also be available.

“We are working to acquire PI&EMI licenses that can provide global finance and payment services,” said CEO Park Kon of WIZBL. “If S-BANK licenses are obtained, small banks will be established perfectly.”

“We will quickly obtain licenses in Lithuania, where regulatory sandboxes are widely applied, and spread financial settlement services using Blockchain around the world,” he said.

The reason why WIZBL is confident in launching global financial payment services using Blockchain is due to the speed of service processing that has been recognized internally and externally.

The essential success factors of global financial services are fast processing speed and high reliability.

Unlike existing financial settlement services, WIZBL chose a decentralization method rather than central server-centered data concentration to optimize transaction (service execution) processing and verification speed to speed up block creation. Through this, it completed the development of ‘BRTE 2.0’ that can be processed in real time last year and plans to start commercializing BRTE 2.0 services from March of this year.

This is based on the Family node and Proof of Maintenance (PoM).

When more than two-thirds of family groups agree to verify transactions, the family node enables rapid processing speed by connecting the blocks to the Blockchain and storing records. Proof and compensation system of BRTE platform consists of PoM, which supports compensation to users who help maintain ecosystem based on the platform’s trust.

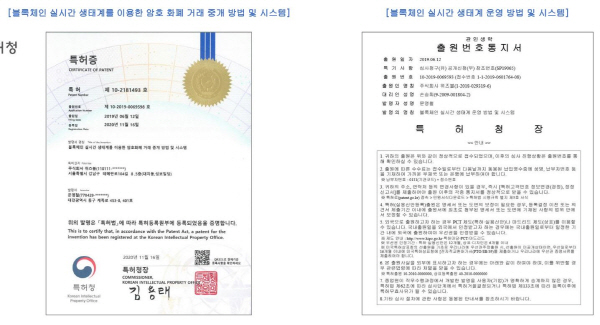

WIZBL was recognized for its technical skills through patent applications such as “How and System to Broker Cryptocurrency Transactions Using the Blockchain Real-Time Ecosystem” and “How and System to Operate the Blockchain Real-Time Ecosystem.”

It is also preparing for training for domestic and foreign professional technology workers.

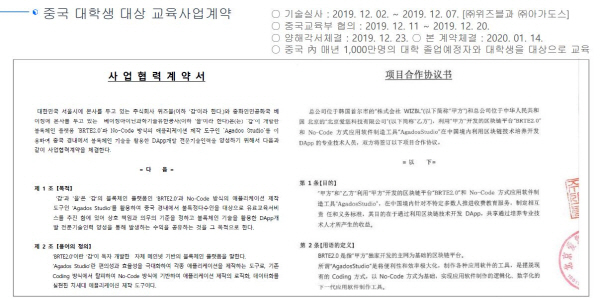

No-code combines Blockchain technology with no-code technology from its partner Agados, a technology that eliminates the coding process and makes it easier to produce programs that were mainly produced by software developers even if they are not experts.

When more than two-thirds of family groups agree to verify transactions, the family node enables rapid processing speed by connecting the blocks to the Blockchain and storing records. Proof and compensation system of BRTE platform consists of PoM, which supports compensation to users who help maintain ecosystem based on the platform’s trust.

WIZBL was recognized for its technical skills through patent applications such as “How and System to Broker Cryptocurrency Transactions Using the Blockchain Real-Time Ecosystem” and “How and System to Operate the Blockchain Real-Time Ecosystem.”

It is also preparing for training for domestic and foreign professional technology workers.

No-code combines Blockchain technology with no-code technology from its partner Agados, a technology that eliminates the coding process and makes it easier to produce programs that were mainly produced by software developers even if they are not experts.

The two companies signed a memorandum of understanding to educate local university students through consultation with the Chinese Ministry of Education in order to produce Blockchain-based no-code platforms, provide cloud services in all fields, build business networks between platforms, and build app stores involving citizen developers around the world.

Currently, pre-video is being produced based on curriculum that was planned by dividing the steps into elementary, middle, and advanced levels.

“Using no-code technology to create distributed apps and web will have a huge impact on many industries and businesses in the future,” said Song Il-myung, an adviser to Tencent, a Chinese partner.

Currently, pre-video is being produced based on curriculum that was planned by dividing the steps into elementary, middle, and advanced levels.

“Using no-code technology to create distributed apps and web will have a huge impact on many industries and businesses in the future,” said Song Il-myung, an adviser to Tencent, a Chinese partner.

Reporter: Lee Han-soo